To get any school help, understudies must document a Free Application for Federal Student Aid.

For the 2020-2021 school year, the FAFSA recording season opens Oct. 1 — and the sooner you document, the better.

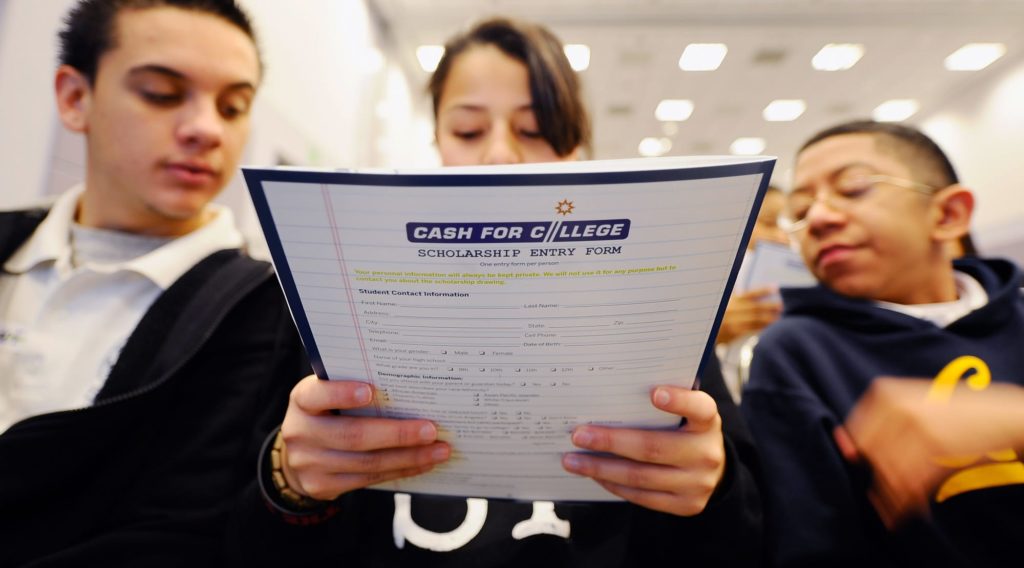

Almost every understudy is qualified for some type of monetary help.

The present reality: Before you settle on which school to visit, you need to concoct an approach to pay for it.

With that in mind, families are depending on money related guide like never before to help spread the soaring expense of educational cost.

More than 8 of every 10 families tap grants and awards — cash that doesn’t need to be reimbursed — and the greater part of families obtain, or take out advances, as indicated by the latest report by instruction moneylender Sallie Mae.

In any case, to get to any of that help, understudies must document a Free Application for Federal Student Aid structure, which fills in as the entryway to all government cash including credits, work-study and awards.

For the 2020-2021 school year, the FAFSA recording season opens Oct. 1 — and the sooner understudies record, the better.

Some budgetary guide is granted on a first-come, first-served premise, or from projects with constrained assets. The prior families round out the FAFSA, the better the opportunity to be in line for that guide, as indicated by Ashley Boucher, a representative for Sallie Mae.

On the off chance that you pause, there might be less cash accessible so your budgetary guide might be more advances, less awards.

Imprint Kantrowitz

SAVINGFORCOLLEGE.COM

“In the event that you pause, there might be less cash accessible so your budgetary guide might be more advances, less awards,” included Mark Kantrowitz, distributer of SavingForCollege.com.

Starting a year ago, 77% of undergrad families finished the FAFSA, up from generally 70% every year sooner, as indicated by Sallie Mae.

Notwithstanding the ascent, a large number of understudies who might have equipped for school awards still neglect to document, Kantrowitz said.

Secondary school graduates in 2017 passed up $2.3 billion in government awards since they didn’t round out the FAFSA by any means, as indicated by an investigation by close to home fund site NerdWallet.

Among the individuals who didn’t make a difference, most said it was on the grounds that they didn’t figure they would qualify. Others said they either didn’t think about it, missed the cutoff time, didn’t have the vital data or felt the application was excessively muddled, the instruction loan specialist found.

What’s more, just 25% did as such as right on time as October, while most of families held up until January or later, possibly passing up free cash for school, Boucher said.

It’s a noteworthy confusion to figure you won’t fit the bill for help, Boucher said. “Almost every understudy is qualified for some type of monetary help, regardless of whether it be awards, work-study reserves, government understudy credits, or a blend.”

Actually, there’s a whole other world to deciding an understudy’s guide than pay and investment funds, for example, the school’s expense of participation or the quantity of school age kin.

Disclaimer: The views, suggestions, and opinions expressed here are the sole responsibility of the experts. No Opinion Bulletin journalist was involved in the writing and production of this article.